Guide for Data in Climate Stress Testing

The United Nations Environment Programme Finance Initiative (UNEP FI) releases guide for data in climate stress testing, aimed at helping financial market participants in collecting and managing Climate-related data.

Climate stress testing is an forward-looking method for assessing the impact of climate change on financial market participants, and high-quality Climate-related data is crucial for identifying and managing climate risks and opportunities. Collecting, processing, and evaluating Climate-related data requires a comprehensive data management process to meet the requirements of stress testing.

Related Post: CFA Institute Releases Climate Data and Investment Report

Introduction to Data in Climate Stress Testing

The data required for climate stress testing can usually be divided into two categories: traditional macro financial data and climate data. Traditional macro data has been used in existing stress tests in the financial industry, such as investment portfolio data (such as balance sheet data, counterparty data), credit data (such as default probability, default loss rate), macroeconomic data (such as GDP, interest rates, and exchange rates), forward-looking forecast data (such as economic forecast scenarios), etc.

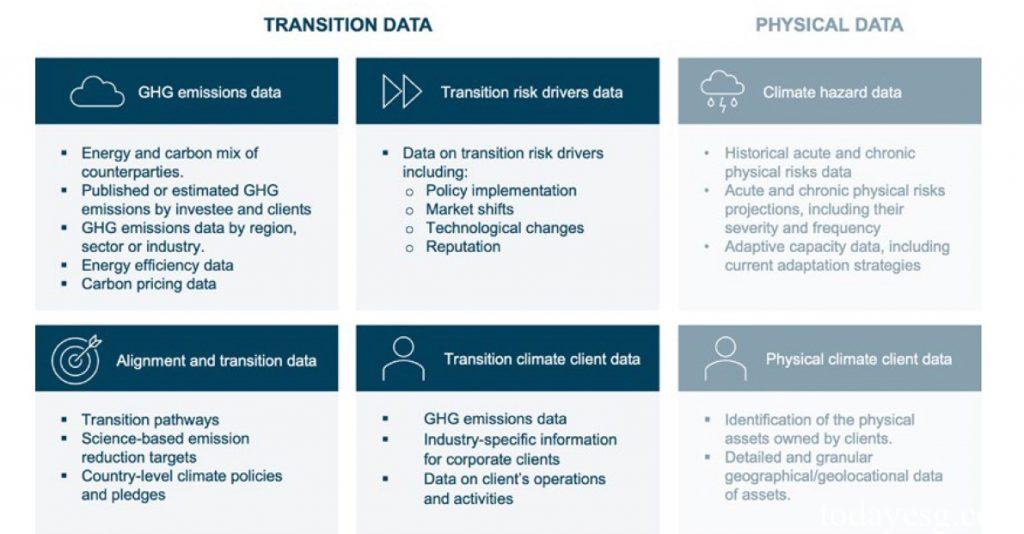

Climate data typically includes two types: physical data and transition data, which correspond to the physical risks and transition risks caused by climate change respectively. Physical data includes information on the damage caused to assets by weather events, while transition data includes information on the impact on financial participants during the transition to a low-carbon economy. Compared to traditional macro financial data, climate data is less, and the methods are still under continuous researches.

Climate-related Physical Data and Transition Data

Climate-related physical data mainly includes climate disaster data, which is the basis for conducting climate stress tests. It includes physical risks as well as the sensitivity and adaptability of entities to these risks. Climate-related physical data includes historical data of specific regional weather events (frequency of occurrence, degree of impact, etc.), predictions of chronic and acute physical risks (probability of occurrence, expected impact, etc.), and asset distribution information (facilities, supply chains, etc.).

Climate-related transition risk data reflects the impact of policies, investor preferences, and technological developments on the transition path, including:

- Transition risk drivers data: The driving factors of transition risk are identified and measured by using proxy variables, such as shadow carbon price.

- GHG emissions data: Greenhouse gas emission data can calculate the transition risks faced by enterprises and identify whether investments are carbon intensive. These data can quantify the risk exposure faced by financial market participants.

- Alignment and transition data: Transition data includes a roadmap for transition plans, including timelines, resource allocation, and transition strategies. These data can help financial market participants develop more practical transition scenarios.

UNEP FI provides an open-source dataset of climate-related physical and transition data, making it easier for financial market participants to search for relevant data before stress testing.

Challenges Faced by Data in Climate Stress Testing

UNEP FI believes that there are still certain shortcomings in the availability, reliability, and comparability of current climate stress test data, for example:

- Data coverage: Most climate data focuses on large companies, with insufficient coverage for small and medium-sized companies. In addition, climate data in Europe and the Americas are relatively complete, while data in other regions is relatively scarce.

- Time lag: Companies usually report climate-related data once a year, which may be completed in the months after the end of the fiscal year. Data entry by third-party data companies also require some time, so data users may not be able to capture the latest development trends in a timely manner.

- Data availability: Climate-related regulatory policies are transitioning from voluntary disclosure to mandatory disclosure, and historical information in the past is often limited, and statistical methods may change, all of which may reduce data availability.

- Data comparability: The climate data disclosed by different companies is related to specific standards in various jurisdictions, making it difficult for financial market participants to standardize this data.

- Data processing capability: Financial market participants may incur high costs in data collection, analysis, and processing, requiring significant investment in data processing, storage and infrastructure.

UNEP FI recommends that financial market participants improve the collection and management processes of climate-related data to prepare for climate stress testing.

Reference:

A Comprehensive Review of Global Supervisory Climate Stress Tests