Hong Kong Sustainable Bond Market Report

The Climate Bonds Initiative (CBI) releases a report on Hong Kong sustainable bond market, aiming to analyze the development of Hong Kong’s green, social, sustainable, and sustainability-linked bond markets.

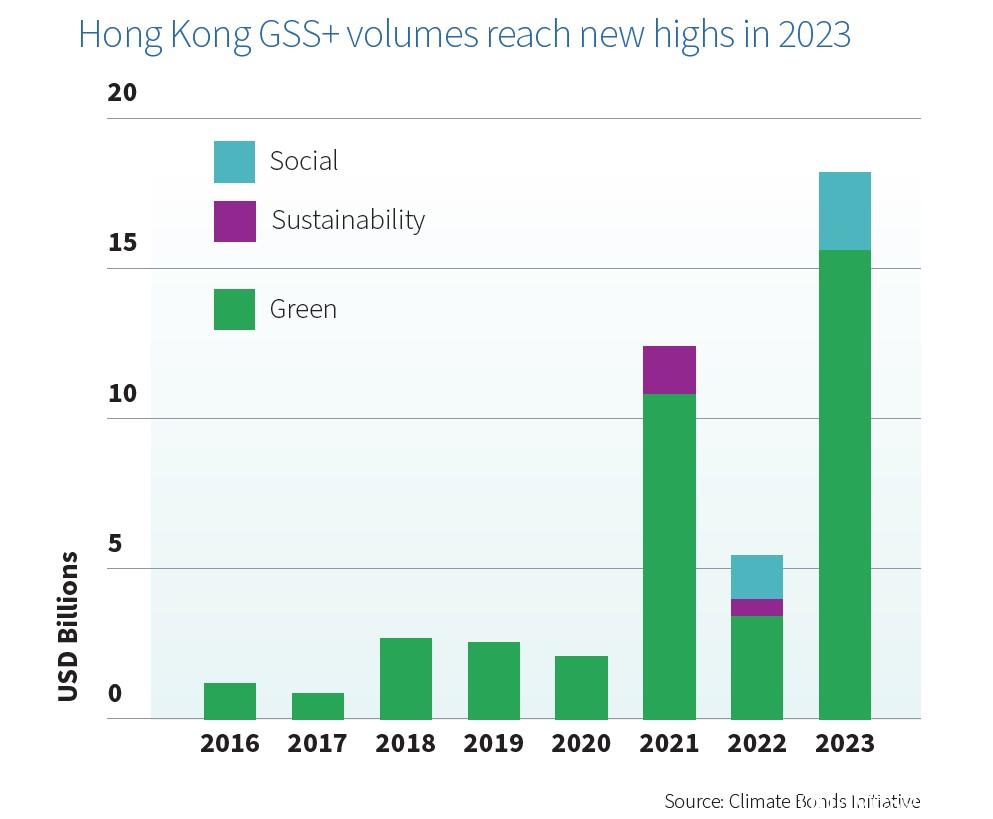

The Hong Kong sustainable bond market report is jointly written by the Climate Bonds Initiative, Hong Kong Monetary Authority, and Hong Kong Green Finance Association, using the Climate Bonds Initiative’s Green, Social, Sustainable, and Sustainability-Linked Bonds (GSS+) dataset. In 2023, Hong Kong issued $18.2 billion in GSS+ bonds, a year-on-year increase of 236%.

Related Post: Hong Kong Monetary Authority Launches Hong Kong Taxonomy for Sustainable Finance

Hong Kong Green Bond Market

The Climate Bonds Initiative determines whether bonds belong to green bonds based on its Climate Bonds Green Bond Dataset. In 2023, the scale of green bond issuance in Hong Kong was 15.6 billion US dollars, a year-on-year increase of 173%, and Hong Kong entered the top ten global green bond destination for the first time. As of the end of 2023, the total amount of green bonds in Hong Kong was 39.3 billion US dollars. Among the newly issued green bonds, green buildings and land use are the main issuance purposes, with the issuance of green building related bonds reaching $4.4 billion, accounting for nearly one-third.

The total issuance of USD bonds in the Hong Kong green bond market is about 42.6%, the total issuance of HKD bonds is about 29.2%, and the total issuance of RMB bonds is about 23.2%. Hong Kong is the preferred location for China’s offshore green bonds in 2023, with 43% of offshore green bonds being issued and listed on the Hong Kong Stock Exchange. In May, the Hong Kong Monetary Authority released the Hong Kong Taxonomy for Sustainable Finance, which provides a definition of the economic activities involved in green bonds.

Hong Kong Social, Sustainable and Sustainability-Linked Bond Market

The Climate Bonds Initiative determines whether bonds belong to social and sustainable bonds based on its Climate Bonds Social and Sustainability Bond Database. The issuance scale of Social and Sustainability Bonds in Hong Kong is 2.56 billion US dollars, which are mainly social bonds. Hong Kong Mortgage Corporation, controlled by the Hong Kong government, has issued $2.5 billion in social bonds to provide financing services for small and medium-sized enterprises.

The Climate Bonds Initiative believes that sustainable bonds refer to bonds whose returns are used for green and social projects, and sustainable bonds are the intersection of green bonds and social bonds. Under this statistical criteria, the number of eligible sustainable bonds is relatively small.

The Climate Bonds Initiative determines whether bonds belong to social and sustainable bonds based on its Climate bonds Sustainability-Linked Bond Database. Based on this criterion, the Sustainability-Linked bonds issued in Hong Kong in 2023 do not meet the definition in the database. At present, there are three Sustainability-Linked bond issuers in Hong Kong, with a total issuance amount of 1.3 billion USD. However, none of these bonds are linked to the issuer’s greenhouse gas emission targets, and therefore are not considered Sustainability-Linked.

Outlook for Hong Kong Sustainable Bond Market

The Climate Bonds Initiative believes that as a global climate financing center, the Hong Kong government will promote the development of a sustainable bond market in the process of achieving climate goals. As of the end of 2023, the Hong Kong government has issued $24.2 billion in government green bonds and plans to issue HKD 95 billion to HKD 135 billion in government bonds annually in the coming years. Hong Kong has announced the extension of the validity period of the Green and Sustainable Finance Funding Scheme until 2027, and the expansion of subsidy coverage to transitional bonds to promote sustainable financing.

The Hong Kong Taxonomy for Sustainable Finance will help eliminate greenwashing and improve the interoperability of sustainable taxonomies between mainland China and the European Union. In the future, Hong Kong will play an important role in decarbonization and transition financing in mainland China.

Reference: