2024 US Sustainable Fund Report

Morningstar releases 2024 US Sustainable Fund Report, aimed at analyzing the development of the US sustainable fund market.

Morningstar finds that in 2024, the number of sustainable funds in the United States will decline for the first time after nine years of continuous growth. This may be due to a decrease in market preference, with the annual increase in sustainable funds being lower than the number closed for the first time.

Related Post: Morningstar Releases 2024 Q3 Global Sustainable Fund Report

Current Status of US Sustainable Fund

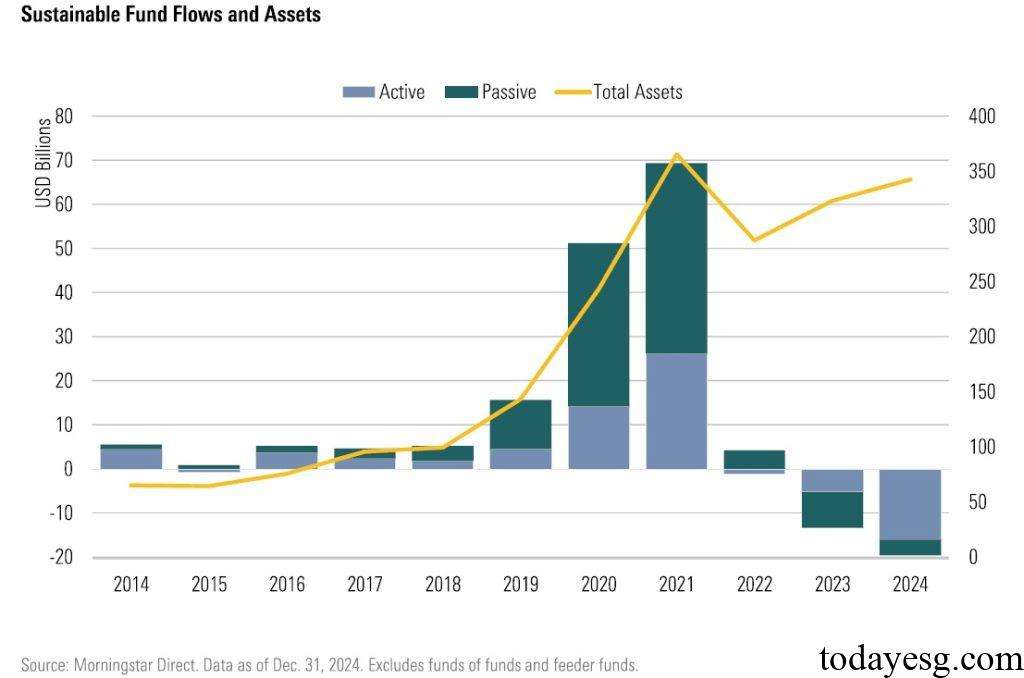

In 2024, there are a total of 587 sustainable funds in the United States, a decrease of 59 compared to 2023. 30% of existing sustainable funds are passive investment funds and 70% are active investment funds. The net outflow of sustainable funds in 2024 is $19.6 billion, which is an expansion compared to the net outflow of $13.3 billion in 2023. The net outflow of funds from passive investment funds was 3.6 billion US dollars, a decrease from 8.2 billion US dollars last year, while the net outflow of funds from active investment funds was 16 billion US dollars, an increase from 5.1 billion US dollars last year.

Despite the negative impact on the number and flow of sustainable funds, the total assets of sustainable funds in the United States reached $344 billion in 2024, an increase of 6.3% compared to 2023. This growth mainly comes from the increase in the net asset value of sustainable funds. Currently, the market is 6% lower than the historical highest asset size in 2021, but it has increased fivefold compared to ten years ago. The proportion of assets in passive investment funds is rapidly increasing. In 2015, the total assets of passive investment funds accounted for 12%, and now it has reached 40%.

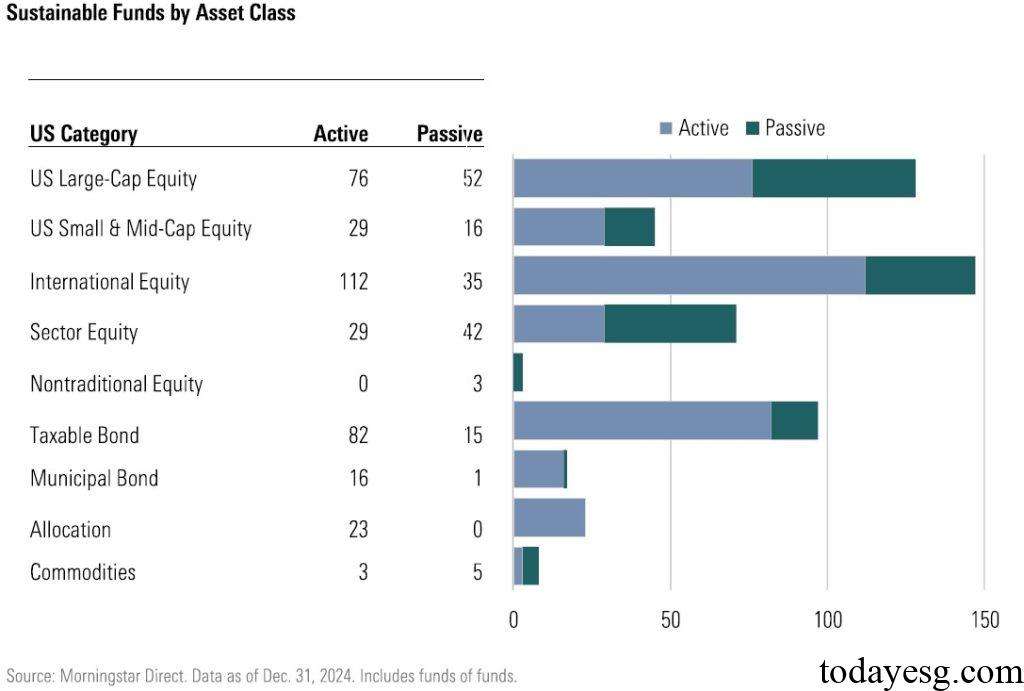

Among the existing sustainable funds, there are 392 equity funds, 114 bond funds, 23 hybrid funds, and 8 commodity funds, respectively. The number of international equity funds is the highest, followed by large cap equity funds and bond funds. In most fund categories, active investment accounts for a relatively high proportion, while there are 42 passive investment funds in the industry equity funds, surpassing active investment funds (29).

In 2024, a total of 10 new sustainable funds were issued in the United States, a significant decrease compared to 2023 (66) and 2022 (103), which is the lowest value since 2015. Among the 10 newly issued funds, 7 are passive investment funds and 3 are active investment funds. This is also the first time since 2015 that the number of passive investment funds issued has exceeded that of active investment funds. These data reflect a decrease in investors’ preference for sustainable funds, while they still retain interest in passive investment sustainable funds.

US Sustainable Fund Performance

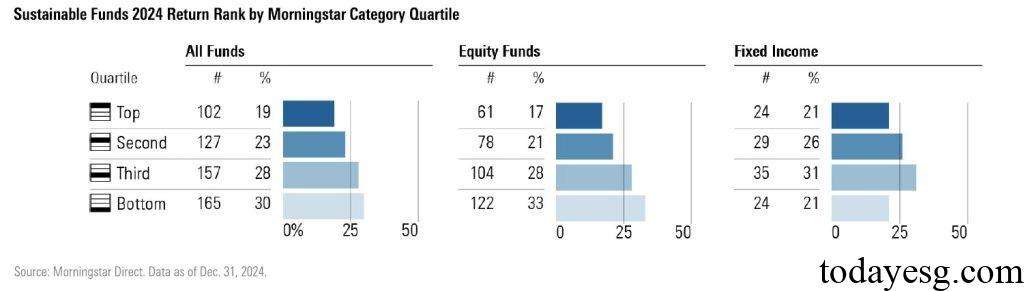

To measure the performance of sustainable funds, Morningstar compares different categories of sustainable funds with their corresponding non-sustainable funds and finds that 42% of sustainable funds reach the top 50% of their category in 2024. The performance of equity sustainable funds is relatively low, with 38% ranking in the top two quartiles. Bond sustainable funds perform well, with 48% ranking in the top two quartiles. Overall, the performance of sustainable funds in 2024 is weaker than that of non-sustainable funds. When the statistical time is extended to the past three and five years, the proportion of sustainable funds in the top 50% is 37% and 46%, respectively.

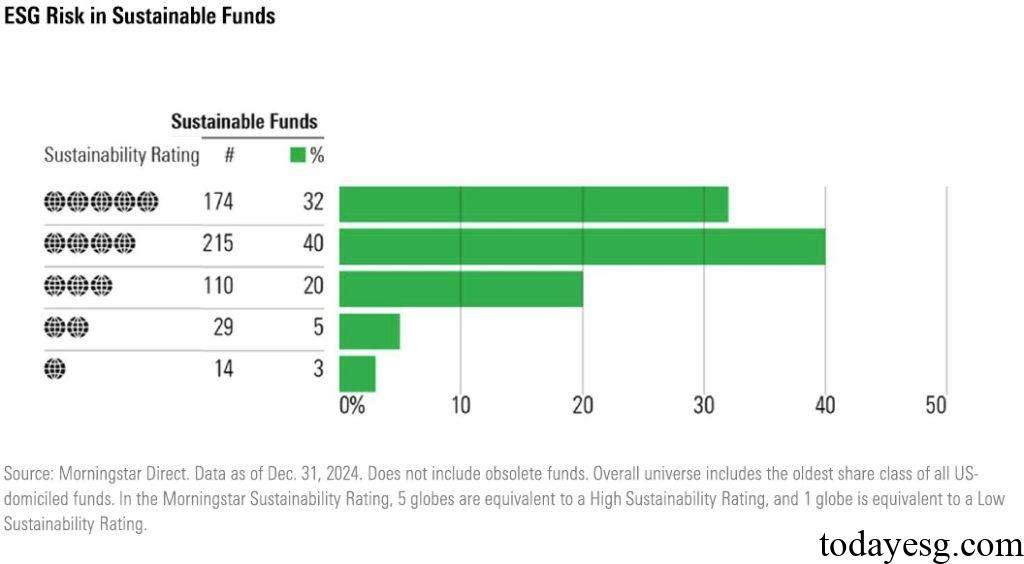

Morningstar analyzes the sustainability performance of sustainability funds based on the Morningstar Sustainability Rating. Morningstar Sustainability Rating is calculated based on the company ratings and sovereign ratings held by the fund’s investment portfolio in the past 12 months. 72% of sustainable funds receive high ratings of 4 and 5, while only 27% of non-sustainable funds receive this rating. 8% of sustainable funds receive two low ratings of 1 and 2, while 29% of non-sustainable funds receive this rating. This data reflects that sustainable funds outperform non-sustainable funds in terms of sustainable performance. The additional focus areas include basic needs, climate action, resource security, and healthy ecosystems.

Reference: